2026 Healthcare Costs Make Preventive Care More Essential Than Ever

In 2026, millions of Americans are facing a healthcare cost crisis — one that affects not just our wallets, but our work, our families, and ultimately our well-being.

Healthcare Costs Are Surging Across the Board

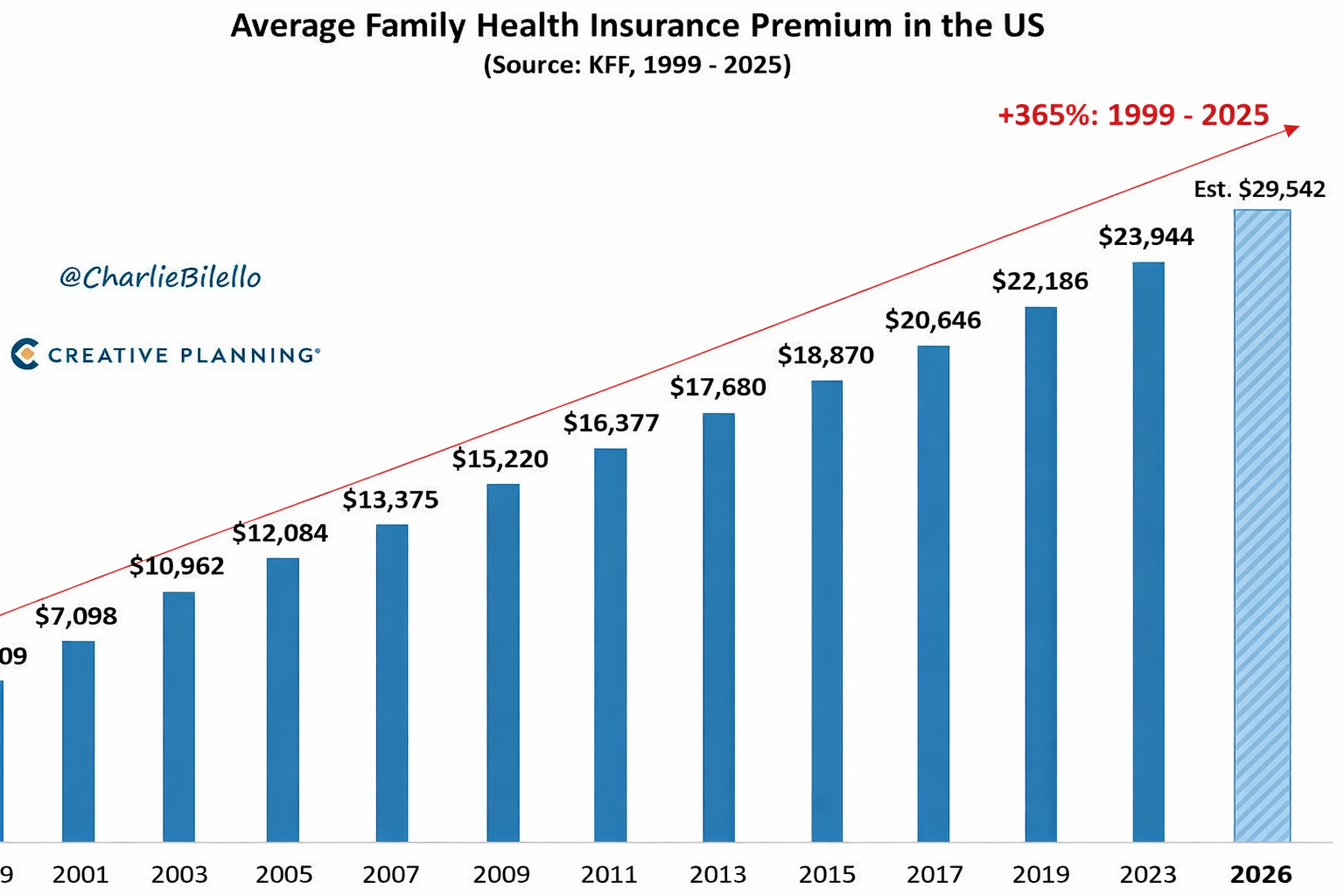

Health insurance premiums are rising sharply this year. For employer-sponsored plans — the benefits that cover most working Americans — costs are expected to climb nearly 9–10% in 2026, driven by expensive prescription drugs, chronic disease care, and new high-cost therapies.

On the Affordable Care Act (ACA) marketplaces, the increases are even steeper: insurers are proposing average premium hikes of about 26% next year. In some states using the federal exchange, premiums could climb 30% or more.

These increases don’t just reflect what insurers charge — they translate into real pain at the checkout. If federal subsidy enhancements expire, many Marketplace enrollees could see premiums more than double, from around $888 to almost $1,904 per year on average, an increase of 114%.

What This Means for Everyday Workers and Families

For most Americans, employer plans are still the most affordable path to care — but even there, employees typically cover 16% to 25% of premium costs through payroll deductions. That means rising premiums cut directly into take-home pay and household budgets.

Higher insurance costs can delay life goals — from buying a home to starting a family — or force people to accept jobs they wouldn’t otherwise take just to retain coverage. And for those who lose subsidies or can’t get employer coverage, the decision to forego insurance entirely becomes a real and dangerous financial risk.

Chronic Disease Is the Major Cost Driver

What’s driving these unsustainable increases? A large portion of U.S. healthcare spending — roughly 90% — goes toward treating chronic and mental health conditions. These include diabetes, heart disease, obesity, and related disorders.

Take diabetes, for example:

In 2022, the total national cost of diagnosed diabetes was an estimated $412.9 billion, including $306.6 billion in direct medical costs and $106.3 billion in indirect costs such as lost productivity and premature death.

On average, someone with diabetes incurs roughly 2.6 times more in medical expenses than a person without the disease — nearly $20,000 per year.

Prediabetes — a condition affecting roughly 86 million U.S. adults — also carries significant financial risk, as about 25% of people with prediabetes progress to type 2 diabetes within five years.

These conditions are not rare exceptions — healthy Americans are the majority at risk. Obesity itself contributes hundreds of billions in extra healthcare expenditures each year and accelerates the onset and severity of other chronic diseases.

“An Ounce of Prevention…”

Benjamin Franklin wisely said, “An ounce of prevention is worth a pound of cure.” When it comes to healthcare costs, this couldn’t be more true.

Just like skipping routine maintenance on a car can lead to a blown engine — a far costlier repair down the road — ignoring early signs of disease or lifestyle risk factors leads to expensive emergency care, hospitalizations, and chronic treatment regimens.

Research shows that lifestyle interventions — such as structured diabetes prevention programs — not only improve health outcomes, but can also generate net savings in healthcare expenditures, even within the first year of participation.

Lifestyle Medicine: Investing in Your Long-Term Health and Wallet

At Concord Longevity Medicine, our focus is on reducing and eliminating chronic disease, improving lifestyle habits, and extending your healthy “health span” — the years you live well and independently.

Preventive lifestyle medicine lifts the heavy burden of disease before it becomes an expensive crisis. It’s not just about lowering numbers on a chart — it’s about reducing your future medical bills, preserving your income, and preventing costly complications before they begin.

In a world where healthcare costs are rising faster than wages and inflation, lifestyle prevention isn’t just smart — it’s one of the most powerful financial and health decisions you can make.